07.02.2022

Interest on a loan on fixed assets. Simplified tax system: acquisition of fixed assets using borrowed funds (Sukhanova E.)

Fixed assets of an organization can be acquired not only using its own funds, but also borrowed funds. Let's consider the features of reflecting in 1C the acquisition of an operating system using credit funds.

You will learn:

- How is the receipt of credit funds reflected?

- in what cases is interest included in the initial cost of the operating system;

- How is the accrual of interest on the loan received reflected?

- what document is used to document the acquisition of fixed assets using loan funds?

- at what point is VAT deductible?

Step-by-step instruction

Let's consider step by step instructions example design.

Depreciation is not considered in this example.

Consider depreciation calculation (business expenses) using an example

Getting a loan from a bank

Receipt Money By loan agreement issued document Receipt to current account transaction type Receiving a loan from a bank In chapter Bank and cash desk – Bank – Bank statements— Admission.

- Sum- the amount received under the loan agreement, according to the bank statement.

- Agreement- loan agreement Type of agreement - Other.

In our example, payments under the loan agreement are carried out in rubles and the agreement term is no more than a year. As a result of selecting such a contract in the document Receipt to the current account automatically installed:

- Settlement account - 66.01 “Short-term loans”.

Postings according to the document

The document generates the posting:

- Dt Kt 66.01 - receipt of funds under a short-term loan agreement.

Transfer of advance payment to the supplier

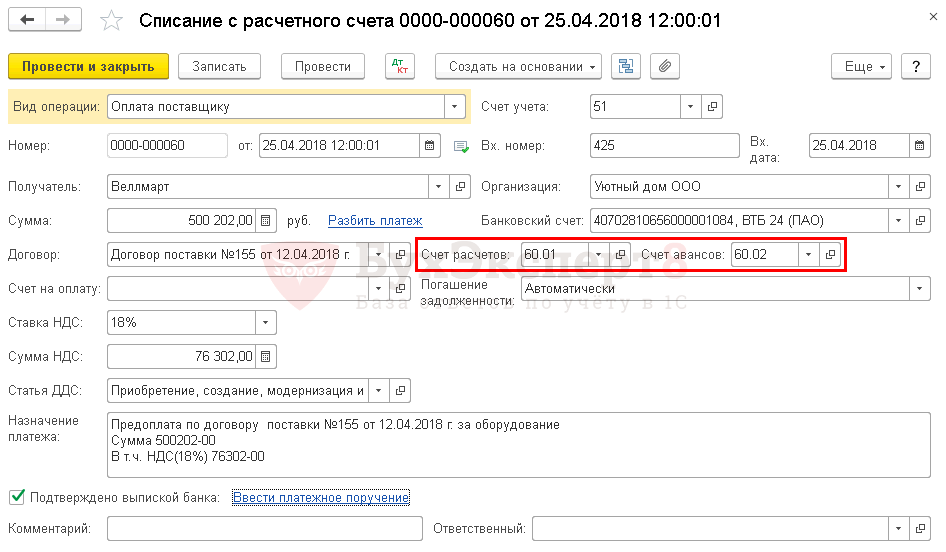

The advance payment to the supplier is reflected document Write-off from current account transaction type Payment to supplier In chapter Bank and cash desk – Bank – Bank statements – Write-offs.

In our example, settlements under the agreement are carried out in rubles. As a result of selecting such a contract in the document Debiting from current account The following subaccounts are automatically established for settlements with the supplier:

- Settlement account - 60.01 “Settlements with suppliers and contractors”;

- Advance account - 60.02 “Settlements for advances issued.”

Please pay attention to filling out the fields:

- Sum- payment amount in rubles, according to the bank statement.

Postings according to the document

The document generates transactions:

- Dt 60.02 Kt - advance payment transferred to the supplier.

If the supplier has issued an advance invoice for prepayment, then the Organization can exercise the right to deduct VAT.

Reflection in accounting of accrued interest on a loan

Interest accrual is reflected document Operation entered manually operation type Operation In chapter Transactions – Accounting – Manual Transactions.

In our example, the fixed asset is not an investment asset, therefore interest is taken into account:

- in accounting as part of other expenses in account 91.02 “Other expenses”;

- in NU as part of non-operating expenses.

Control

The bank calculates interest on the loan, so the accountant only needs to enter a transaction with an already known amount of interest. But it is still advisable to control the amount of interest calculated by the bank.

Similarly, you can control the calculation of the interest amount in the following months.

Reporting

In the income tax return, the amount of accrued interest is reflected as part of non-operating expenses in Sheet 02 Appendix No. 2:

- p. 200 “Non-operating expenses - total” incl.

- p. 201 “expenses in the form of interest on debt obligations...”.

Purchasing an OS

In 1C there are two options for registering the acquisition and accounting of fixed assets:

Standard option, which uses two documents:

- capitalization of OS - document Receipt (act, invoice) type of operation Equipment ;

- OS commissioning - document Acceptance of fixed assets for accounting .

Simplified version, which uses a single document:

- capitalization and commissioning of OS - document Receipt (act, invoice) type of operation Fixed assets .

When accounting for fixed assets acquired using credit funds, you can choose any method, but you need to take others into account restrictions provided for the simplified version.

In our example, there are no restrictions on the use of the simplified version, so we will formalize the acceptance of fixed assets for accounting using a singledocument Receipt (act, invoice) transaction type Fixed assets In chapter Fixed assets and intangible assets – Receipt of fixed assets – Receipt of fixed assets.

The header of the document states:

- Method of reflecting depreciation expenses - method of accounting for the cost of depreciation of fixed assets, selected from directory Method of reflecting expenses.

In our example, depreciation costs will be taken into account as part of business expenses, since the fixed assets will be used for marketing purposes. Due to the fact that the Organization is engaged in production, account 44.02 “Business expenses in organizations engaged in industrial and other production activities” will be used for this purpose.

- OS accounting group - cars and equipment.

- OS location - place of operation of the OS, selected from the Division directory.

- The checkbox is not checked: in our example, the purchased object will be used for our own needs.

The tabular section indicates:

- The main thing - acquired OS object that must be created in directory Fixed assets.

- Life time- useful life (SPI) for the object. In this document, only one SPI can be established - the same for NU and BU.

Automatic invoicing in columns Account And Depreciation account depends on the checkbox Objects are intended for rent . Since this checkbox is not checked, then:

- Account 01.01 “Fixed assets in the organization” will be installed;

- Depreciation account 02.01 “Depreciation of fixed assets accounted for in account 01” will be set.

When posting a document, a fixed asset card in the directory Fixed assets will be filled in as follows. Wherein Depreciation group will be determined automatically depending on the service life specified in the document.

The remaining data in the OS card must be filled in manually.

Postings according to the document

The document generates transactions:

- Dt 08.04.2 Kt 60.01 - formation initial cost asset;

- Dt 01.01 Kt 08.04.2 - acceptance of the asset into the OS.

Documenting

The organization must approve the forms of primary documents, including the document on commissioning of the OS and the form of the inventory card for further accounting of the OS. In 1C, the OS Acceptance and Transfer Certificate (OS-1) and the OS Inventory Card (OS-6) are used.

The OS-1 acceptance certificate form can be printed using the button Stamp – Certificate of acceptance and transfer of OS (OS-1) document Receipt (act, invoice) .

The OS Inventory Card form in the OS-6 form can be printed using the button OS inventory card (OS-6) in the fixed asset card: section Directories – OS and intangible assets – Fixed assets.

Reflection in accounting

The value of assets acquired for a fee is determined by summing up the value of the assets indicated in the primary accounting documents and the actual costs incurred associated with their acquisition, incl. carried out by other persons on the basis of contracts. This rule is contained in Art. 11 of the Law of the Republic of Belarus dated October 18, 1994 No. 3321-XII “On Accounting and Reporting” (as amended and supplemented).

Let us turn to the standards of the Instructions for accounting fixed assets, approved by Decree of the Ministry of Finance of the Republic of Belarus dated December 12, 2001 No. 118 (with amendments and additions; hereinafter referred to as Instruction No. 118). It (paragraphs 10, 11) states that fixed assets are valued in accounting at their original or replacement cost. The initial value is the cost at which assets are accepted for accounting as fixed assets. This is the amount of actual costs for their acquisition, construction, manufacturing, delivery, installation and installation, including:

Services of third parties (supplier, intermediary, contractor and other organizations) related to the acquisition of fixed assets;

Customs payments;

Transportation insurance costs;

Interest on loans and borrowings (except for interest on overdue loans and borrowings);

Amount differences arising in settlements of obligations associated with the acquisition of fixed assets in cases where payment is made in Belarusian rubles in an amount equivalent to the amount specified in the contract in foreign currency (conventional monetary units), except for organizations financed from the budget;

Expenses associated with the purchase of currency for settlement of obligations associated with the acquisition of fixed assets;

Loading and unloading operations;

Taxes, unless otherwise provided by law;

Other costs directly related to the acquisition, construction and manufacture of an item of fixed assets and bringing it to a state in which it is suitable for use.

Thus, interest on loans and borrowings (except for interest on overdue loans and borrowings), if they are related to the acquisition of fixed assets, is included in its cost.

It is clear that it is not always possible to make a full payment for the purchased fixed asset before it is put into operation. For this reason, there is often a need to pay interest on loans received for the purchase of fixed assets after they are put into operation.

Until January 1, 2010, Instruction No. 118 in paragraph 17 explained that the cost of fixed assets at which they are accepted for accounting cannot be changed, except in the following cases:

Modernization, reconstruction, partial liquidation, additional equipment, completion, technical diagnostics and relevant examination, other capital works;

Carrying out revaluation of fixed assets in accordance with the law;

Inclusion at the end of the reporting year in the cost of fixed assets of costs incurred (accrued) after the commissioning of fixed assets and separately accounted for during the reporting year as investments in non-current assets:

Interest on loans and borrowings (except for interest on overdue loans and borrowings);

Exchange differences from revaluation accounts payable on obligations related to the acquisition of fixed assets, and amount differences arising in the settlement of obligations related to the acquisition of fixed assets (exception - organizations financed from the republican and (or) local budgets on the basis of budget estimates, having a current account with bank institutions and maintaining accounting records in accordance with the Chart of Accounts for accounting the execution of cost estimates of organizations financed from the budget);

Expenses associated with the purchase of currency for settlement of obligations associated with the acquisition of fixed assets.

By Decree of the Ministry of Finance of the Republic of Belarus dated October 30, 2009 No. 132 “On amendments to the Decree of the Ministry of Finance of the Republic of Belarus dated December 12, 2001 No. 118” (came into force on January 1, 2010) the fifth paragraph was excluded from paragraph 17 of Instruction No. 118, as a result, interest on loans and borrowings cannot be attributed to the cost of fixed assets at which they were previously accepted for accounting. In other words, if an object of fixed assets has already been registered under account 01 “Fixed Assets” in accordance with the law, then after that interest on loans and borrowings can no longer be attributed to account 01.

The specified interest on loans and borrowings cannot be included in the cost of products (works, services), since the rule provided for in subclause must be observed. 3.22 Basic provisions on the composition of costs included in the cost of products (works, services), approved by Resolution of the Ministry of Economy, Ministry of Finance and Ministry of Labor and Social Protection of the Republic of Belarus dated October 30, 2008 No. 210/161/151. This rule states: the cost of products (works, services) includes interest on loans and credits received, with the exception of interest on overdue loans and credits, as well as loans and credits related to the acquisition of fixed assets, intangible assets and other non-current (long-term) assets.

Note that when purchasing other assets, for example, raw materials, there is a need to pay interest on loans after these assets are reflected in accounting. How are they reflected in accounting?

As we see from the above norm, they can be included in the cost of products (works, services). There is another source of their reflection.

To summarize information about operating income and expenses of the reporting period, incl. on expenses (interest) accrued by the organization after accepting for accounting inventory acquired through short-term and long-term loans and borrowings, as well as interest on other short-term and long-term loans and borrowings (except for loans and borrowings received for the purchase of fixed assets and intangible assets, interest on which at the end of the year is charged to the cost of the corresponding assets) account 91 “Operating income and expenses” is intended (see Instructions for the use of the Standard Chart of Accounts, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated May 30, 2003 No. 89 (as amended and additions; hereinafter - Instruction No. 89)).

Exception given (in italics. - Note ed.) in terms of interest on loans and borrowings received for the purchase of fixed assets, which at the end of the year are included in the cost of fixed assets, was completely justified, since Instruction No. 118 clearly indicated the procedure for their reflection, i.e. allocation to increase the cost of fixed assets.

However, from January 1, 2010, this procedure cannot be applied. In this regard, we believe that interest on loans and borrowings related to the acquisition of fixed assets, after they are put into operation (accepted for accounting under account 01), by analogy with the same expenses arising from the acquisition of other inventory items, should be reflected on account 91 as part of operating expenses.

Reflection in tax accounting

Costs of production and sale of goods (works, services), property rights taken into account for tax purposes, represent the valuation of goods (works, services), property rights used in the production and sale process, natural resources, raw materials, materials, fuel, energy, fixed assets, intangible assets, labor resources and other expenses for their production and sale, reflected in accounting (Article 130 of the Special Part Tax Code RB (hereinafter - NK)).

The Tax Code does not contain a list of costs taken into account for tax purposes. At the same time, in Art. 131 of the Tax Code lists costs that are not taken into account for tax purposes. In particular, on the basis of sub. 1.20 of this article, expenses not taken into account for taxation include interest on overdue loans and credits, as well as loans and credits associated with the acquisition of fixed assets, intangible assets and other non-current (long-term) assets.

Thus, this rule does not allow interest on loans and borrowings associated with the acquisition of fixed assets to be attributed to expenses taken into account for tax purposes. According to the author, this state of affairs will not facilitate the attraction of borrowed funds for the acquisition of fixed assets and will seriously complicate the work of organizations.

From the editor:

The adoption of Resolution of the Ministry of Finance of the Republic of Belarus dated October 30, 2009 No. 132 once again proves that such acts must be adopted with awareness of the consequences of such decisions. The fact is that during the period of validity of the previous documents there was utmost clarity on this issue. After all, earlier in Art. 3 of the Law of the Republic of Belarus dated December 22, 1991 No. 1330-XII “On taxes on income and profit” there was a provision that interest on overdue loans and credits, as well as loans and credits related to the acquisition of fixed assets, are not included in the costs of production and sale of products, goods (works, services) taken into account for taxation. However, these expenses were recognized when taxing profits as costs of production of products (works, services). Indeed, the costs taken into account when taxing profits included depreciation of fixed assets, calculated from the increased value of the fixed asset at the end of the year on which such payments (interest on loans) took place.

In the Tax Code, interest on loans and credits associated with the acquisition of fixed assets is specified in Art. 131, which lists costs that are not taken into account for tax purposes. Now the possibility of taking into account in the cost of fixed assets interest on loans and credits paid after the commissioning of fixed assets into operation is completely excluded (Resolution of the Ministry of Finance of the Republic of Belarus dated October 30, 2009 No. 132).

Why has the approach to reflecting these expenses changed so much? It is believed that the inclusion of these amounts in costs will lead to a significant increase in the cost of manufactured products (works, services) and will increase the number of unprofitable enterprises.

Isn’t it strange to artificially make enterprises profitable by excluding real costs from production costs and pretending that they do not exist?

When making such decisions, you need to be aware of the consequences: imagine what kind of profitability should be included in the price finished products to cover such costs through after-tax profits. Let's take into account the eternal economic laws!

"New in accounting and reporting", 2007, N 12

Recently, the Russian Ministry of Finance issued a new Letter in which it clarified the accounting procedure for the purposes of calculating income tax for expenses in the form of interest on loans issued for the purchase of equipment during the period of mothballing equipment installation work. We are talking about Letter dated April 2, 2007 N 03-03-06/1/204.

In this document, financial department specialists actually made two conclusions:

- interest on the loan paid by the taxpayer during the creation of the production line must be taken into account as part of the initial cost of the construction project;

- expenses in the form of interest on loans issued for the purchase of equipment during the period of conservation of equipment installation work are taken into account when determining tax base for income tax as part of non-operating expenses in an amount not exceeding that established by Art. 269 of the Tax Code of the Russian Federation.

Accounting for interest during the mothballing period

Let's start by analyzing the validity of the second conclusion. Let us say right away that the financiers’ explanations on this issue are legitimate. As the Russian Ministry of Finance correctly pointed out, in paragraphs. 2 p. 1 art. 265, art. 269 of the Tax Code of the Russian Federation establishes a special procedure for accounting for interest on loans and credits.

So, according to paragraphs. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, non-operating expenses not related to production and sales include expenses in the form of interest on debt obligations of any type, including interest accrued on securities and other obligations issued (issued) by the taxpayer, taking into account the features provided for in Art. . 269 of the Tax Code of the Russian Federation (for banks, the specifics of determining expenses in the form of interest are determined in accordance with Articles 269 and 291 of the Tax Code of the Russian Federation), as well as interest paid in connection with the restructuring of debts on taxes and fees in accordance with the procedure established by the Government of the Russian Federation.

Taking into account the above, the Russian Ministry of Finance recognized that expenses in the form of interest on loans issued for the purchase of equipment are taken into account for profit tax purposes as part of non-operating expenses.

Accounting for interest as part of the initial cost of a fixed asset

But the first conclusion of officials is far from indisputable. The financiers based their reasoning on the norm of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation: the initial cost of a fixed asset is determined as the amount of expenses for its acquisition (and if the fixed asset was received by the taxpayer free of charge, as the amount at which such property is valued in accordance with clause 8 of Article 250 of the Tax Code of the Russian Federation), construction, manufacturing, delivery and bringing it to a state in which it is suitable for use, with the exception of VAT and excise taxes, except in cases provided for by the Tax Code of the Russian Federation.

Based on this, the Russian Ministry of Finance came to the conclusion that interest on the loan paid by the taxpayer during the creation of the production line should be taken into account as part of the initial cost of the construction project.

It is difficult to agree with this approach. The fact is that in paragraph 1 of Art. 257 of the Tax Code of the Russian Federation contains a rather abstract definition of expenses to be included in the initial cost of a fixed asset. Since the law does not contain a specific list of such expenses, various ways of interpreting the analyzed provision are possible. The Russian Ministry of Finance actually applied a broad interpretation.

Meanwhile, another interpretation of the norm in question is possible. Following a restrictive interpretation, it can be assumed that interest on a loan should not participate in the formation of the initial cost of a fixed asset. In any case, in paragraph 1 of Art. 257 of the Tax Code of the Russian Federation says nothing about them.

In addition, the Russian Ministry of Finance does not deny that a special accounting procedure has been established for interest on loans and credits in paragraphs. 2 p. 1 art. 265 Tax Code of the Russian Federation, art. 269 of the Tax Code of the Russian Federation.

However, officials, when interpreting the law, lost sight of the following. According to paragraph 4 of Art. 252 of the Tax Code of the Russian Federation, if some expenses with equal grounds can be attributed simultaneously to several groups of expenses, the taxpayer has the right to independently determine which group he will assign such expenses to. This means, even if we assume that in paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, the legislator really meant interest for the use of borrowed funds; the taxpayer has the right to decide for himself how to qualify these costs.

With this approach, the company has two options for accounting for interest:

- include them in the initial cost of the fixed asset;

- included in non-operating expenses.

Obviously, from an economic point of view, the second accounting option is more profitable. The fact is that the organization gets the opportunity to write off interest as expenses of the current period, and not over many years of depreciation of the fixed asset. And if so, then the taxpayer, guided by clause 4 of Art. 252, pp. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, has the right to qualify the costs under study as non-operating expenses.

Position of arbitration courts

The conclusions drawn are confirmed by arbitration practice. As an example, let us cite the Resolution of the Federal Antimonopoly Service of the North-Western District dated March 22, 2005 in case No. A42-8523/04-28.

Example. The inspection carried out on-site inspection compliance by the company with legislation on taxes and fees, during which a number of violations were revealed. In particular, the tax authority established that the taxpayer, on the basis of loan agreements, received funds, which he used to pay for the purchased vessel. The company paid interest under these loan agreements, which it included in non-operating expenses taken into account when taxing profits.

The tax authority decided to assess additional taxes to the company, accrue penalties and bring it to tax liability. The company considered the inspectors' decision illegal and challenged it in the arbitration court.

The court of first instance considered the additional charge of income tax justified, indicating that interest paid by the company before accepting the vessel for accounting should be included in the initial cost of the vessel and in expenses taken into account for taxation as depreciation is calculated.

However, the higher court assessed the circumstances of the case differently, drawing attention to the fact that the Tax Code of the Russian Federation establishes the specifics of accepting and accounting for certain types of expenses. So, according to paragraph 2 of Art. 252 of the Tax Code of the Russian Federation, expenses, depending on their nature, as well as the conditions of conduct and areas of activity of the taxpayer, are divided into expenses associated with production and sales, and non-operating expenses.

When purchasing a vessel using borrowed funds, the taxpayer bears both costs associated with production and sales (expenses for the acquisition of depreciable property) and non-operating expenses (in the form of interest on debt obligations) (clause 2, clause 1, article 265 of the Tax Code of the Russian Federation) . For taxpayers who recognize expenses using the accrual method, costs for the acquisition of depreciable property are included in expenses taken into account when taxing profits as depreciation is calculated in the manner established by clause 3 of Art. 272 of the Tax Code of the Russian Federation.

Non-operating expenses are taken into account in the reporting period to which they relate. Moreover, for expenses such as interest on borrowed obligations, the date of their implementation is the date of settlement established in accordance with the terms of the concluded agreements (clause 1, subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

Since the company became obligated to pay interest on borrowed funds (and the interest was actually paid to the lenders), the court recognized that it lawfully included this interest in non-operating expenses taken into account when taxing profits.

The cassation court did not agree with the conclusion of the court of first instance that interest on loan agreements paid before the vessel was put into operation should be included in the initial cost of the vessel and written off as depreciation is calculated. FAS emphasized that Art. 257 of the Tax Code of the Russian Federation does not provide for the inclusion in the initial cost of depreciable property of interest paid on borrowed funds used to purchase property, since such interest is included in an independent group of expenses - non-operating expenses.

The cassation instance recognized the use of the rules established by PBU 6/01 by the court of first instance in this case as erroneous.<1>, since these rules apply only in the field of accounting. For the purposes of income taxation, special tax accounting is provided, the procedure for maintaining which is established by the norms of Chapter. 25 Tax Code of the Russian Federation.

<1>The accounting regulations “Accounting for fixed assets” PBU 6/01 were approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

Taking into account the above, the court decided that the company rightfully included in non-operating expenses interest paid on loans used to purchase fixed assets.

The above precedent clearly demonstrates that the taxpayer has the right to take into account interest on loans as non-operating expenses. However, since there is an opposing point of view of the Russian Ministry of Finance, there is a risk that tax authorities may make claims against the taxpayer. Therefore, the organization must be prepared for the fact that it will have to defend its interests in arbitration court.

Accounting rules for interest

So, we have examined the procedure for reflecting in tax accounting interest paid on loans that are raised for the construction of fixed assets. Now a few words about the reflection of interest in accounting.

The procedure for determining the initial cost of fixed assets for accounting purposes is established in PBU 6/01. In accordance with clause 8 of this Regulation, the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, excluding VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

When resolving the issue under consideration, PBU 15/01 should also be taken into account<1>. According to clause 12 of PBU 15/01, costs for loans and credits received must be recognized as expenses for the period in which they were incurred, with the exception of that part of them that is subject to inclusion in the cost of the investment asset.

<1>The accounting regulations “Accounting for loans and credits and the costs of servicing them” (PBU 15/01) were approved by Order of the Ministry of Finance of Russia dated August 2, 2001 N 60n.

For the purposes of PBU 15/01, an investment asset is understood as an object of property, the preparation of which for its intended use requires significant time. Investment assets include fixed assets, property complexes and other similar assets that require a lot of time and costs for acquisition and (or) construction (clause 13 of PBU 15/01).

Thus, in accounting, unlike tax accounting, interest on loans and borrowings must be included in the initial cost of the fixed asset.

O.A.Myasnikov

Simplified tax system: acquisition of fixed assets using borrowed funds (Sukhanova E.)

Date of article posting: 09/14/2013

When calculating the single tax, “simplified” people who have chosen the appropriate object of taxation have the right to take into account only a limited list of expenses. But it contains both interest on received loans and borrowings, as well as the costs of acquiring fixed assets. Meanwhile, the initial cost of fixed assets on the simplified tax system is formed according to accounting rules, according to which it may also include interest on the loan...

“Simplers” with the object of taxation “income minus expenses” recognize in tax accounting the expenses listed in clause 1 of Art. 346.16 of the Internal Revenue Code. Under paragraphs. 1 it includes expenses for the acquisition of fixed assets, and under paragraphs. 9 - interest paid for the provision of funds (credits, borrowings) for use. But to what type of expenses should the corresponding interest be attributed if the loan was received specifically for the purpose of purchasing fixed assets?

OS acquisition costs

Under the simplified tax system, fixed assets are understood as fixed assets that are recognized as depreciable property in accordance with the provisions of Chapter. 25 of the Tax Code (clause 4 of article 346.16 of the Tax Code). Therefore, firstly, we are talking about part of the property used as means of labor for the production and sale of goods (performing work, providing services) or for managing an organization, with an initial cost of more than 40,000 rubles. (Clause 1 of Article 257 of the Tax Code). Secondly, it must belong to the taxpayer by right of ownership, be used to generate income and have a useful life of at least 12 months (clause 1 of Article 256 of the Tax Code).

When purchasing fixed assets directly during the period of application of the simplified tax system, their cost is included in expenses from the moment the object is put into operation (submitting documents for registration of property rights, if required) and is taken into account during tax period, that is, a year, in equal shares for reporting periods(Clause 3 of Article 346.16 of the Tax Code). The procedure for recognizing such expenses assumes that they are taken into account on the last day of the reporting (tax) period in the amount of the amounts paid. Thus, as representatives of the Ministry of Finance explain, the taxpayer has the right to begin writing off the cost of fixed assets acquired during the period of application of the simplified tax system from the reporting period when the last of two conditions is met: commissioning or payment of the fixed asset. At the same time, if we are talking about real estate, you will have to wait for the third condition to be fulfilled, namely the submission of documents for state registration of rights to the object real estate(Letters of the Ministry of Finance of Russia dated April 15, 2009 N 03-11-06/2/65, dated June 6, 2008 N 03-11-05/142, Federal Tax Service of Russia dated March 31, 2011 N KE-3-3 /1003).

Interest on the use of funds

Clause 2 of Art. 346.16 of the Tax Code provides that expenses in the form of interest on loans and credits are accepted for accounting on the simplified tax system in the manner prescribed for income tax payers. In other words, “simplified people” in this case must be guided by Art. 269 of the Code, and therefore, for the purpose of calculating the single tax, interest paid on loans and borrowings is subject to normalization.

Article 269 of the Tax Code offers taxpayers a choice of two ways to determine the limit on the recognition of interest in expenses.

The first assumes that the calculation of the maximum amount of interest taken into account for tax purposes is based on the average level of interest on comparable loans in one quarter (the deviation should not exceed 20% in one direction or another).

The second prescribes focusing on the Bank of Russia refinancing rate, increased by a certain coefficient. Thus, if we are talking about interest on a debt obligation expressed in rubles, then the limit on recognizing their amount in expenses until the end of the current year is determined based on the Bank of Russia rate increased by 1.8 times, and for foreign currency loans and borrowings - based on rates of the Bank of Russia, multiplied by a coefficient of 0.8 (clause 1.1 of Article 269 of the Tax Code).

Any taxpayer has the right to choose from the proposed methods, the main thing is to secure it in accounting policy. Another thing is that in the absence of comparable loans, willy-nilly you will have to focus on the refinancing rate of the Bank of Russia.

In the book of income and expenses, expenses in the form of interest on loans and borrowings are reflected on the date of their payment, if, of course, by that moment they can be considered completed. In other words, two conditions must be met: the billing period for which interest is accrued must end and the debt on it must be repaid.

Loan interest and investment asset

The initial cost of a fixed asset created or acquired after the transition to the simplified system is formed according to the accounting rules (clause 3 of Article 346.16 of the Tax Code, clause 3.10 of the Procedure for filling out the book of income and expenses on the simplified tax system, approved by Order of the Ministry of Finance of Russia dated October 22 2012 N 135n). According to clause 8 of PBU 6/01 “Accounting for fixed assets”, it consists of the actual costs of acquisition, construction and production, with the exception of value added tax and other refundable taxes. At the same time, loan interest is not mentioned among these, but it is mentioned that the cost of an asset can include “other costs” directly related to its purchase or production.

In turn, PBU 15/2008 “Accounting for expenses on loans and credits” (approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n) directly stipulates that interest payable to the lender directly related to the acquisition of an investment asset is included at its original cost (clause 7 of PBU 15/2008). An object in respect of which two conditions are simultaneously met is recognized as such:

- preparing an object for use requires a long time;

- the acquisition, construction and (or) production of an object requires significant expenses.

Note! Small businesses are allowed to independently choose the procedure for accounting for borrowing costs: either in the cost of an investment asset or as part of other expenses (clause 7 of PBU 15/2008).

What terms should be considered “long” and expenses “significant” are not deciphered in the PBU. The corresponding criteria must be developed independently by a business entity and consolidated in its accounting policies. Thus, a fixed asset can also be recognized as an investment asset. And interest on a loan or credit spent on the acquisition of fixed assets is included in the cost if the following conditions are met:

- expenses for the acquisition, construction and (or) production of an investment asset are subject to recognition in accounting;

- borrowing costs associated with the acquisition, construction and (or) production of an investment asset are subject to recognition in accounting;

- work has begun on the acquisition, construction and (or) production of an investment asset (clause 9 of PBU 15/2008).

Among other things, this means that the cost of an asset can only include interest that was paid before its commissioning or the start of actual use in business. Interest amounts that are not transferred to the cost of the fixed asset are written off as other expenses.

Between two options

In a Letter dated June 11, 2013, representatives of the Russian Ministry of Finance indicated that interest on loans and borrowings, even if received and spent on the acquisition of fixed assets, should still be taken into account in the simplified tax system in accordance with paragraphs. 9 clause 1 art. 346.16 of the Internal Revenue Code. Among other things, this means that they can be taken into account only within the limits established by Art. 269 of the Code.

At the same time, speaking about the interest paid by the “simplified” in connection with the acquisition of fixed assets in installments, specialists from the financial department order that they be included in the cost of the fixed assets and written off in accordance with paragraphs 1 and 3 of Art. 346.16 of the Tax Code (Letters of the Ministry of Finance of Russia dated June 30, 2011 N 03-11-06/2/101, dated July 2, 2010 N 03-11-11/182). Let us recall that installment payment is a type of commercial loan (clause 1 of Article 823 of the Civil Code). Meanwhile, as officials point out, according to clause 23 of the Regulations on accounting and reporting (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n), the actually incurred costs when assessing property include, in particular, the costs of its acquisition , including interest paid on a commercial loan provided upon acquisition of fixed assets. Similar conclusions are contained in the Letter of the Federal Tax Service of Russia dated February 6, 2012 No. ED-4-3/1818.

Such a different approach to purchasing fixed assets in installments and using borrowed funds can be explained, perhaps, only by the fact that, on the basis of paragraphs. 9 clause 1 art. 346.16 of the Tax Code takes into account interest paid for the provision of funds for use (credits, borrowings). Meanwhile, at commercial loan, in particular, when paying in installments, the taxpayer does not directly receive funds for use. Consequently, the specified norm of the Tax Code is not applicable in this case.

Often a company needs borrowed funds - for example, to invest in non-current assets. In this case, the accountant has a lot of questions regarding accounting for accrued interest. Nalian Kulaeva, a tax consultant at BKR-INTERCOM-AUDIT CJSC, will help you sort them out.

PBU will help

Guided by clause 23 of the Accounting Regulations “Accounting for loans and credits and the costs of servicing them” (PBU 15/01), the organization must include the amount of interest in the initial cost of the object, which is subsequently written off as costs through the depreciation mechanism. A different procedure for accounting for interest, namely writing off current expenses, is provided for by PBU 15/01 only for borrowed funds associated with the formation of investment assets, for which depreciation is not charged in accounting.

When determining the tax base, it is impossible to take into account the costs of acquiring and creating depreciable property (clause 5 of Article 270 of the Tax Code of the Russian Federation). Based on this, the amount of accrued interest should be taken into account in the initial cost of such an object, especially since Art. 257 of the Tax Code of the Russian Federation directly states that the initial cost of a fixed asset takes into account all expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use. The only exceptions are VAT and excise taxes, except in cases provided for by the Tax Code of the Russian Federation. Obviously, in this case, the amount of interest on targeted borrowed funds is associated with the acquisition of fixed assets...

At the same time, Chapter 25 of the Tax Code of the Russian Federation also contains a special norm enshrined in paragraphs. 2 clause 1 art. 265 Tax Code of the Russian Federation. Expenses in the form of interest on obligations of any type - both current and investment - taking into account the requirements of Art. 269 of the Tax Code of the Russian Federation are included in non-operating expenses. Therefore, taxpayers must reflect interest accrued for the use of borrowed funds as non-operating expenses. Despite the fact that the work of an accountant becomes more labor-intensive, from an economic point of view this accounting option is beneficial for the taxpayer, allowing the company to reduce tax payments, since the amount of accrued interest (taking into account the requirements of Article 269 of the Tax Code of the Russian Federation) reduces the profit of the current period. Moreover, both the Ministry of Finance of the Russian Federation and the tax authorities for a long time did not object to such tactics.

However, now the situation seems to be changing, and this is due to the appearance of Letter of the Ministry of Finance of the Russian Federation dated April 2, 2007 No. 03-03-06/1/204. In response to a private question from a taxpayer about the procedure for calculating interest during the period of equipment conservation, the Ministry of Finance of the Russian Federation provided clarification on how the amount of accrued interest on loan servicing should be taken into account. It follows from the provisions of this letter that during the period of conservation of work on the installation of an object, the taxpayer has the right to take into account the amounts of accrued interest as part of non-operating expenses.

However, another important conclusion practically follows from the letter - that during the period of creation of the object, interest on the loan paid by the taxpayer should be taken into account in its original cost.

Therefore, now many accountants are concerned about how in tax accounting they should keep track of interest that is accrued for the use of borrowed funds taken to purchase depreciable property.

attention

The inclusion of interest in the initial cost of an object ceases from the first day of the month following the month the asset was accepted for accounting as an object of fixed assets (clause 30 of PBU 15/01). If an asset is not accepted for accounting as a fixed asset, but its actual operation has begun, then the inclusion of interest in the initial cost ceases from the first day of the month following the month of the actual start of operation (clause 31 of PBU 15/01).

What options?

According to the author, the current version of Chapter 25 of the Tax Code of the Russian Federation does not give an unambiguous answer to this question, therefore, based on the provisions of paragraph 1 of Art. 257 Tax Code of the Russian Federation, clause 4, art. 252 of the Tax Code of the Russian Federation, clause 5 of Art. 270 Tax Code of the Russian Federation, paragraph 2, paragraph 1, art. 265 of the Tax Code of the Russian Federation and Art. 269 of the Tax Code of the Russian Federation, a taxpayer has several options for accounting for interest:

- Interest until the asset is accepted for accounting is included in the initial cost of the asset, and then taken into account as part of non-operating expenses;

- Interest is included in non-operating expenses;

- Interest until the asset is accepted for accounting is included in the initial cost; after that, it is not taken into account for tax purposes.

The first option is beneficial from the point of view of bringing accounting closer together, but increases the amount of tax payments, the second option reduces tax payments, but ultimately leads to the emergence of differences between balance sheet and taxable profit (clause 1 of Article 257 of the Tax Code of the Russian Federation and clause 5 of Article 270 Tax Code of the Russian Federation). The third is not beneficial at all from the taxpayer’s point of view, but nevertheless also has a “right to life.”

Since tax accounting for interest on targeted borrowed funds taken for the acquisition (creation) of fixed assets today does not have an unambiguous interpretation, then, in the author’s opinion, the organization has the right to decide independently how it will account for interest. When resolving this issue, the company must proceed from the fact that it is more profitable for it - closer accounting or reduction of tax payments to the treasury. The selected option is fixed in the accounting policy for tax purposes.

Example

To purchase equipment, organization “A” took out a targeted loan from the bank in the amount of 2,000,000 rubles at 15% per annum for a period of six months. In accordance with the terms of the agreement, interest is paid to the bank on a monthly basis.

The loan was received on April 10 of this year. The cost of the equipment is 2,360,000 rubles (including VAT - 360,000 rubles). Payment to the supplier was made on April 12, delivery cost - 23,600 rubles, including VAT - 3,600 rubles. The object was registered in May of this year and its use began in the same month.

The accounting policy for tax purposes stipulates that before an object is accepted for accounting, interest on the use of borrowed funds is included in the initial cost of the object (clause 4 of Article 252 of the Tax Code of the Russian Federation), and then taken into account as part of non-operating expenses. The useful life in accounting is established in accordance with the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. Let's assume that this equipment belongs to the fourth depreciation group, the established useful life is 61 months, depreciation is calculated using the straight-line method.

To simplify the example, let us assume that the amount of accrued interest does not exceed the maximum amount limited by the requirements of Art. 269 of the Tax Code of the Russian Federation.

In the accounting records of organization “A”, these business transactions are reflected as follows: Using option 1 gives the same amount of the initial cost of equipment in accounting and tax accounting - 2,070,432.87 rubles - and, accordingly, the amount of accrued depreciation in accounting and tax accounting will be is the same, amounting to 33,941.52 rubles.

Using option 2 gives different amounts of the initial cost of the fixed assets: in accounting - 2,070,432.87 rubles, and in tax accounting - 2,000,000 rubles.

The amount of depreciation in accounting is 33,941.52 rubles, in tax accounting - 32,786.89 rubles. A deductible temporary difference arises, leading to the formation of a deferred tax asset (DTA) (33,941.52 - 32,786.89) × 24% = 277.11 rubles. An entry should be made in accounting: Debit 09 Credit 68. However, the use this option leads to a reduction in the company's tax payments.

| Account correspondence | Amount, rubles | Contents of operation | |

|---|---|---|---|

| Debit | Credit | ||

| April | |||

| 51 | 66 | 2 000 000 | Received a targeted loan for the purchase of equipment |

| 60 | 51 | 2 000 000 | Payment made to supplier |

| 08 | 60 | 2 000 000 | The cost of equipment is reflected as part of investments in non-current assets |

| 19 | 60 | 360 000 | VAT presented for payment by the supplier is reflected |

| 08 | 66 | 20 367,12 | Interest accrued for using the loan in April 15% / (365 / 100) × 2,360,000 × 21 days |

| May | |||

| 66 | 51 | 20 367,12 | Interest paid to the bank for April |

| 08 | 76 | 20 000 | The cost of equipment delivery is included in the original cost |

| 19 | 76 | 3 600 | VAT presented by the carrier is reflected |

| 08 | 66 | 30 065,75 | Interest accrued on the loan for May 15% / (365 / 100) × 2,360,000 × 31 days |

| 01 | 08 | 2 070 432,87 | Equipment is accepted for accounting as a fixed asset |

| 68 | 19 | 363 600 | Accepted for VAT deduction |

| 76 | 51 | 23 600 | Carrier services paid |

| June | |||

| 66 | 51 | 30 065,75 | Interest paid to the bank for May |

| 91-2 | 66 | 29 095,89 | Interest accrued for using the loan in June 15% / (365 / 100) × 2,360,000 × 30 days |

| 20 | 02 | 33 941,52 | Depreciation accrued for June |